When buying a home, you’re probably thinking about mortgage rates, home prices, your down payment, and maybe even your closing costs. But you may not be thinking about homeowners association (HOA) fees. While you won’t necessarily have these, you should know it’s a possibility, depending on where you decide to live.

A homeowners association is basically an organization that oversees a housing community (including shared spaces) and sets and enforces rules for things like upkeep. Some buyers love the perks that come with an HOA, others may see the fees as an extra expense. The key is knowing what they cover and whether the benefits outweigh the costs for you.

The Benefits of Having an HOA

Think about this. If you’ve fallen in love with a home because of how beautiful the community is – maybe it’s the landscaping, the well-maintained streets, or the overall curb appeal – there’s a good chance the HOA is one of the reasons why it looks so good. Here are some of the biggest perks:

- Neighborhood Maintenance: Many HOAs cover landscaping, snow removal, and upkeep of common areas. This helps maintain the neighborhood’s overall appearance.

- Amenities: Depending on the neighborhood, an HOA could also include access to perks like a pool, clubhouse, fitness center, or even private security. In these cases, while you have to pay an HOA fee, you’re also saving money in some ways because you don’t need to have separate gym or pool memberships anymore.

- Property Value Protection: Since HOAs enforce community standards, they prevent homes from falling into disrepair. So, you don’t have to worry about nearby eyesores hurting your property value.

- Less Personal Upkeep: In some communities, HOAs even take care of exterior maintenance, roof repairs, or other shared responsibilities, reducing the work for homeowners.

HOA Fees: More Common, Especially in Newer Neighborhoods

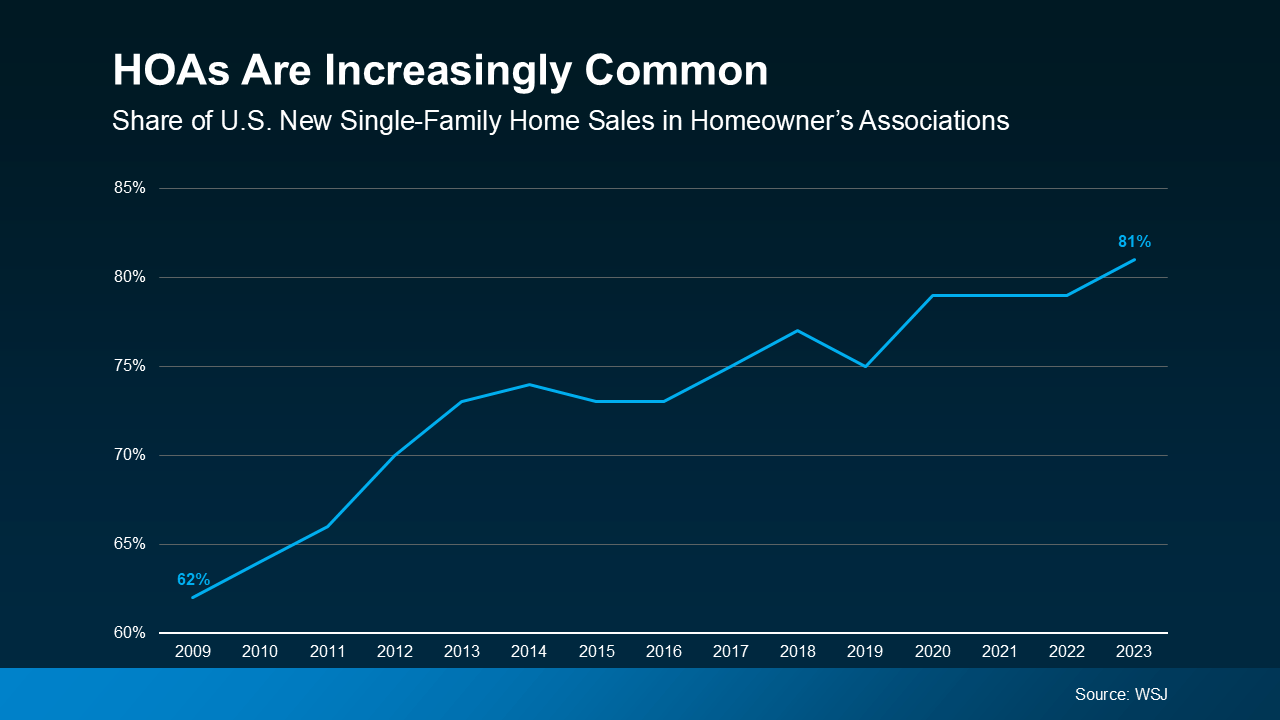

Does every house have HOA fees? No, not all homes have them. But they are common, especially in newer communities. In fact, over 80% of newly built single-family homes are now part of an HOA, according to the Wall Street Journal (see graph below):

But it’s not just new builds that have homeowners associations. Homes that were previously lived in may have an HOA fee too. According to Axios roughly 4 out of every 10 homes had an HOA in 2024.

But it’s not just new builds that have homeowners associations. Homes that were previously lived in may have an HOA fee too. According to Axios roughly 4 out of every 10 homes had an HOA in 2024.

HOA Fees and Your Home Search

Ask your agent about which homes do and do not have HOA fees as part of your search – and how much the fees are. Some neighborhoods have quarterly dues, some have monthly, some don’t have any at all. To give you some sort of baseline though, the median HOA fee rose last year to $125 per month, based on a report from Realtor.com.

But remember, the costs vary and sometimes these fees give you access to great perks. As Danielle Hale, Chief Economist at Realtor.com, explains:

“When considering a home with an HOA, buyers should work to understand what benefits it provides like maintenance, security, or communal amenities, and how the HOA fees factor into their overall budget.”

Bottom Line

Before buying a home in an HOA community, it’s a good idea to review the rules and fees so you know exactly what’s included, how that fits into your overall budget, and what restrictions may apply.

Would you rather pay an HOA fee for added perks, or skip it and have full control over your property? Let’s talk about what’s best for you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

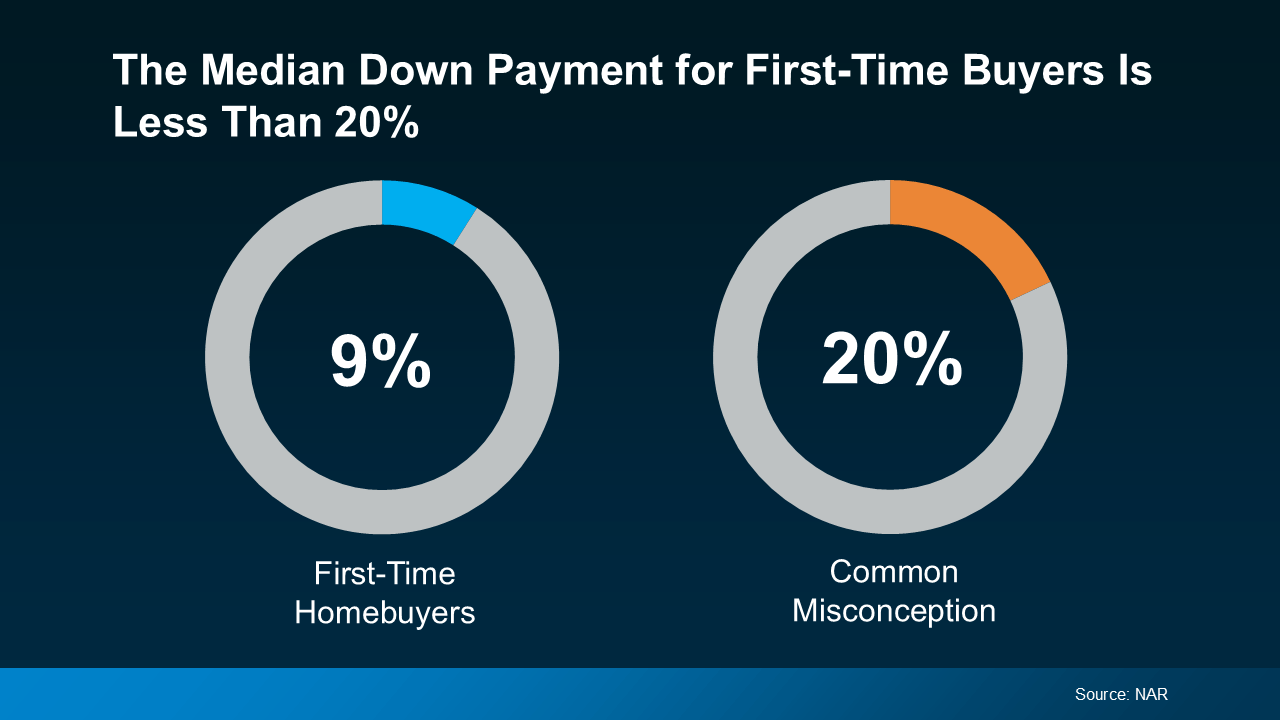

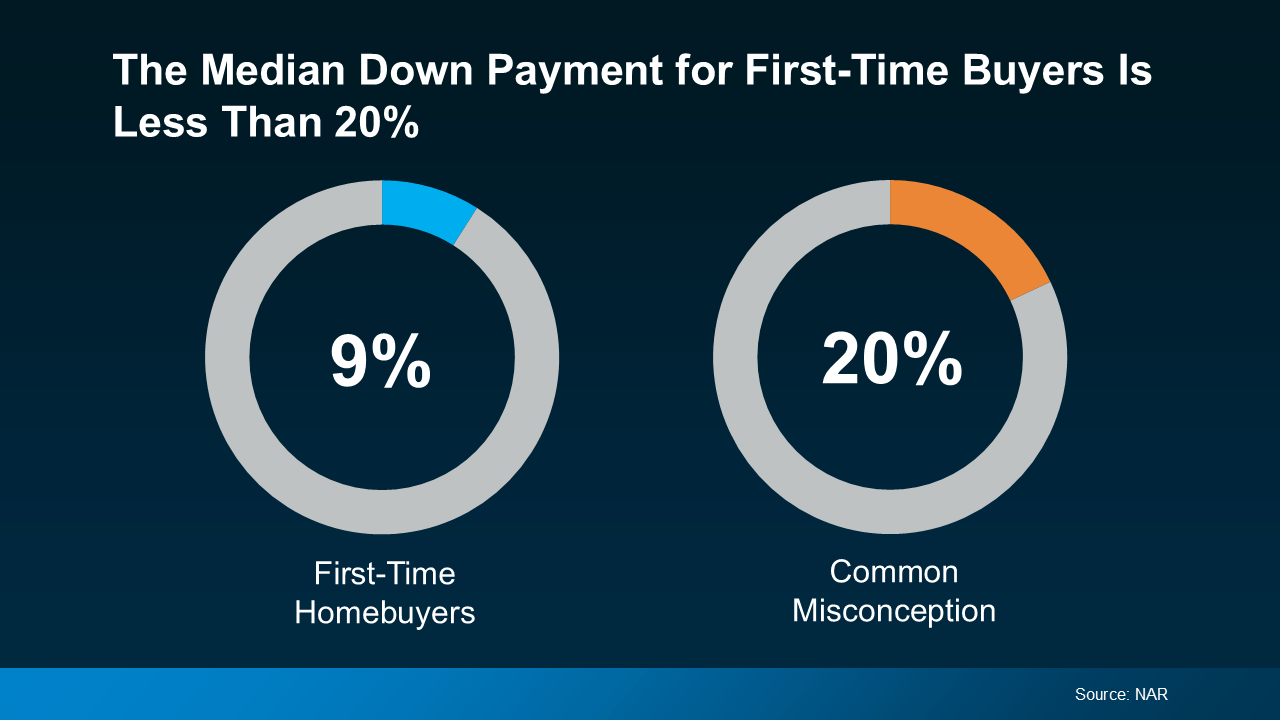

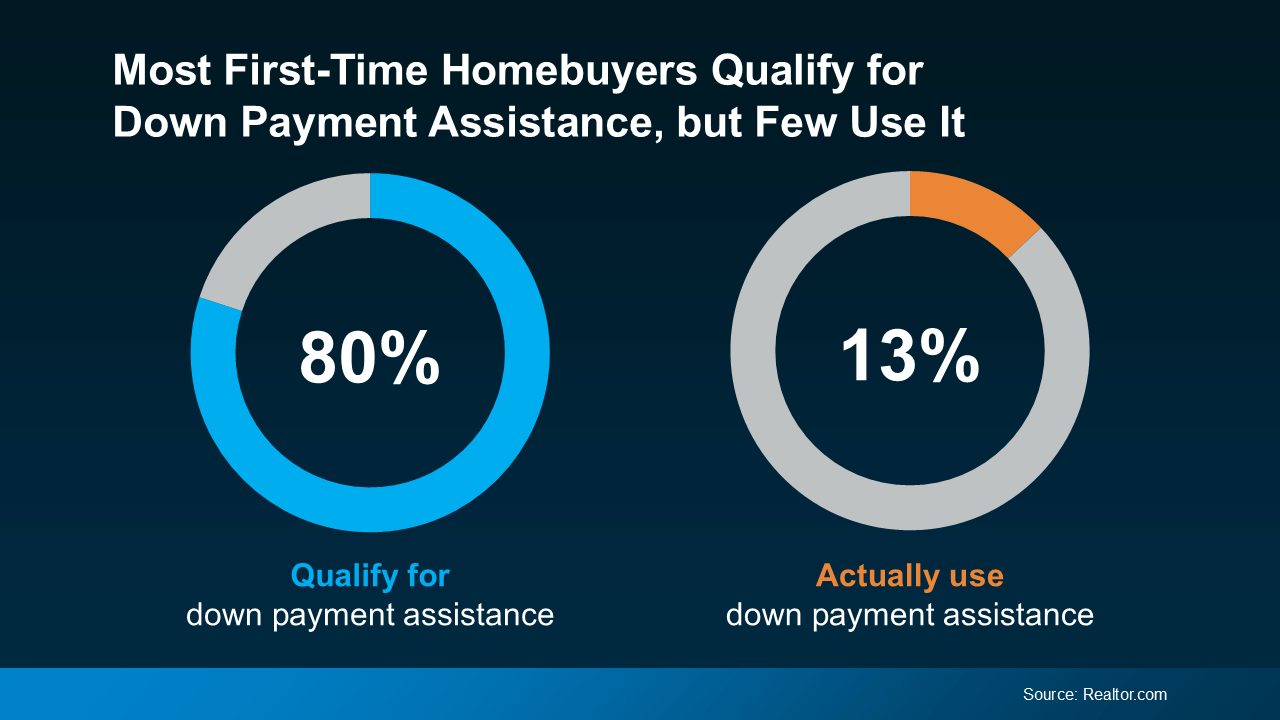

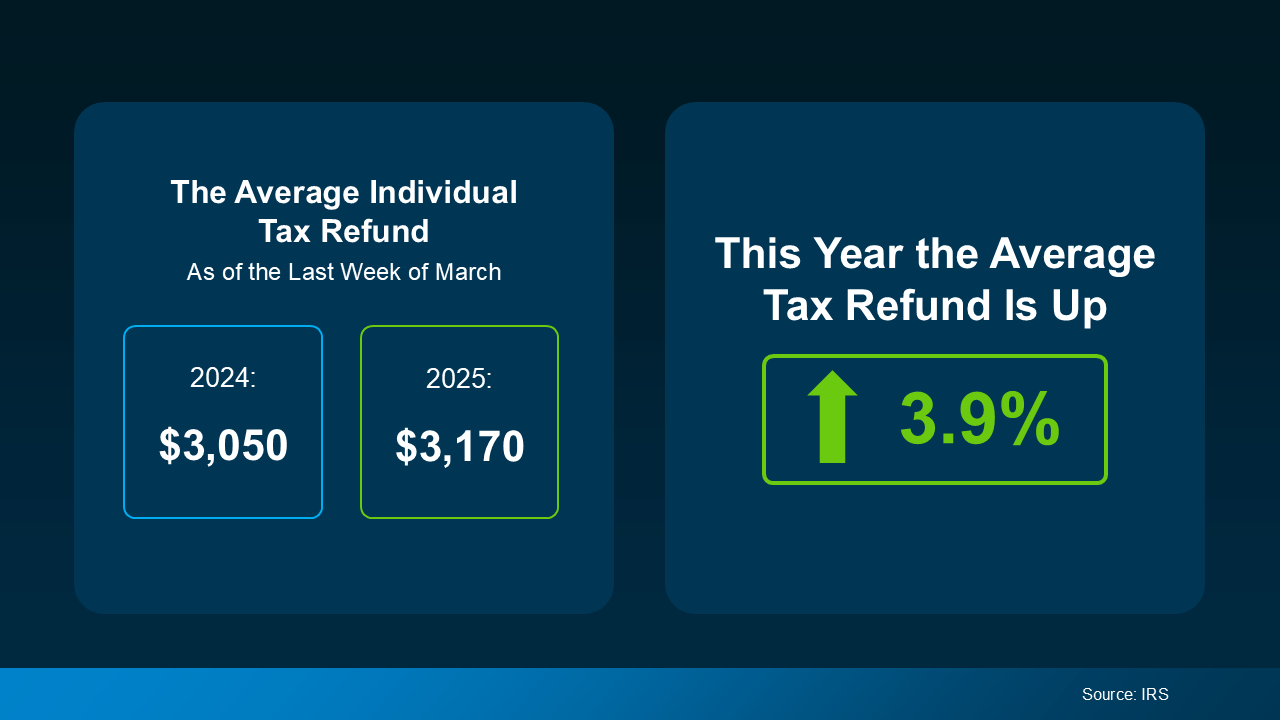

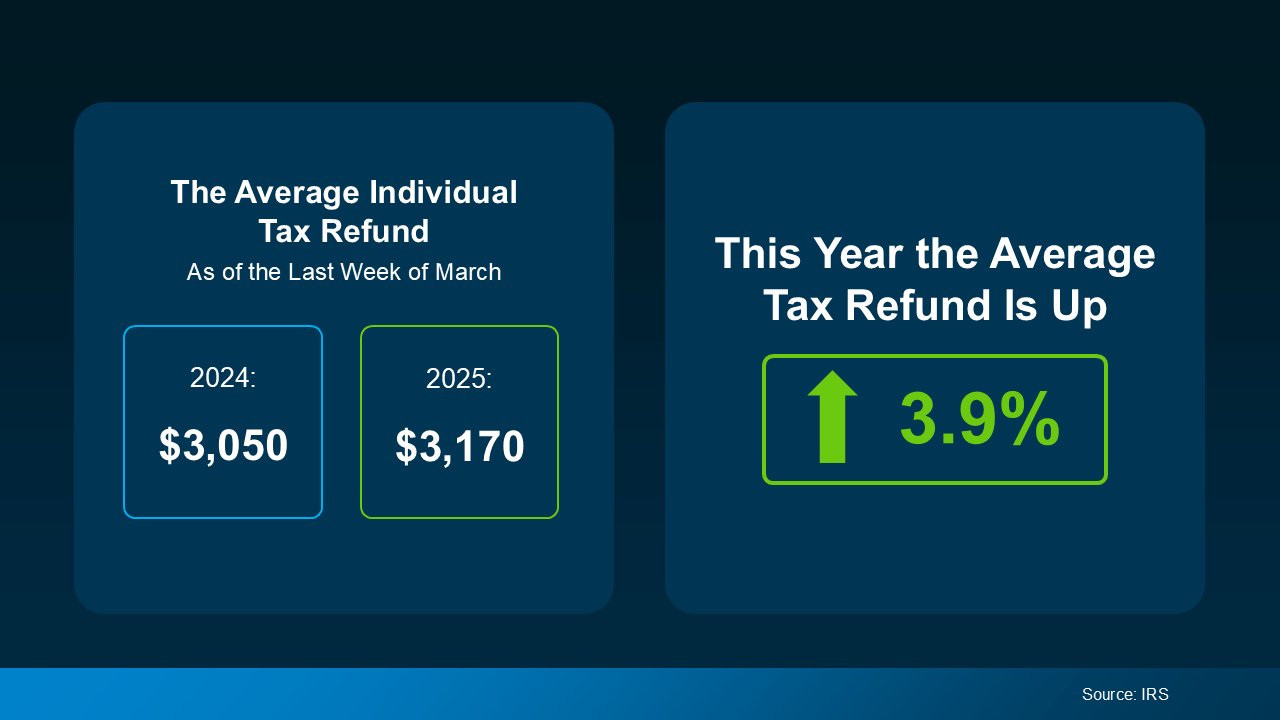

The takeaway? You may not need to save as much as you originally thought.

The takeaway? You may not need to save as much as you originally thought.

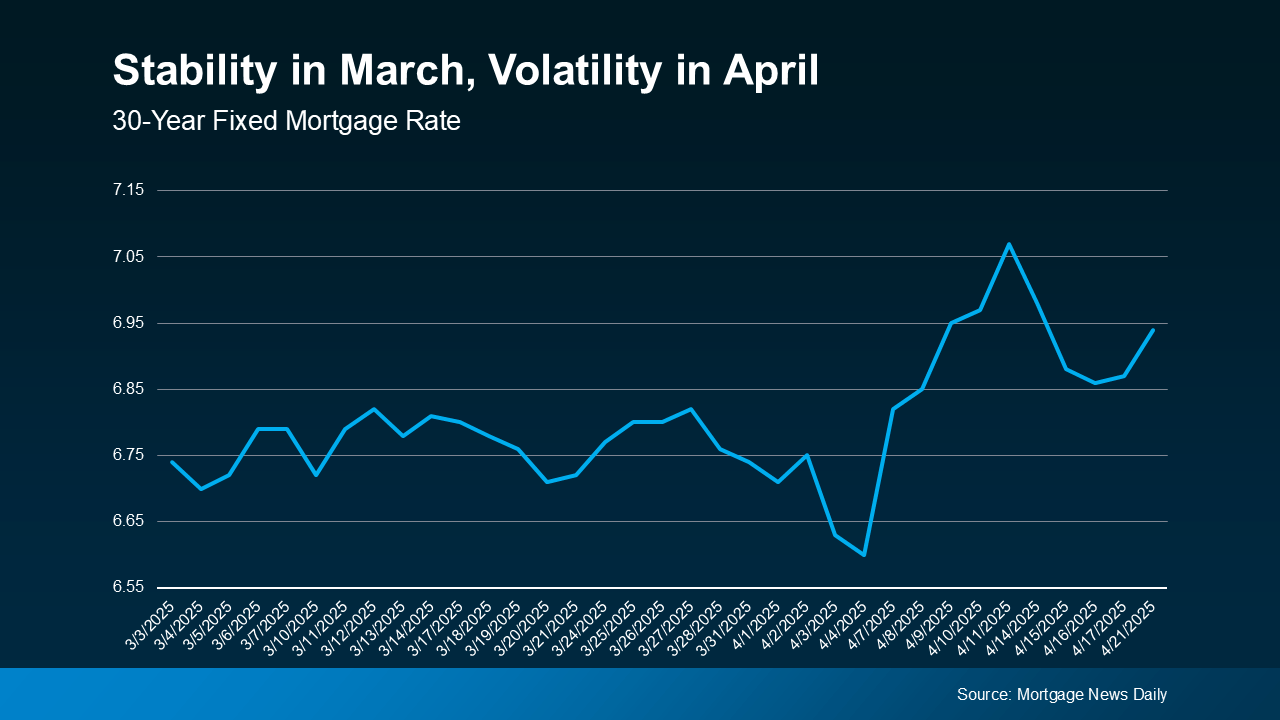

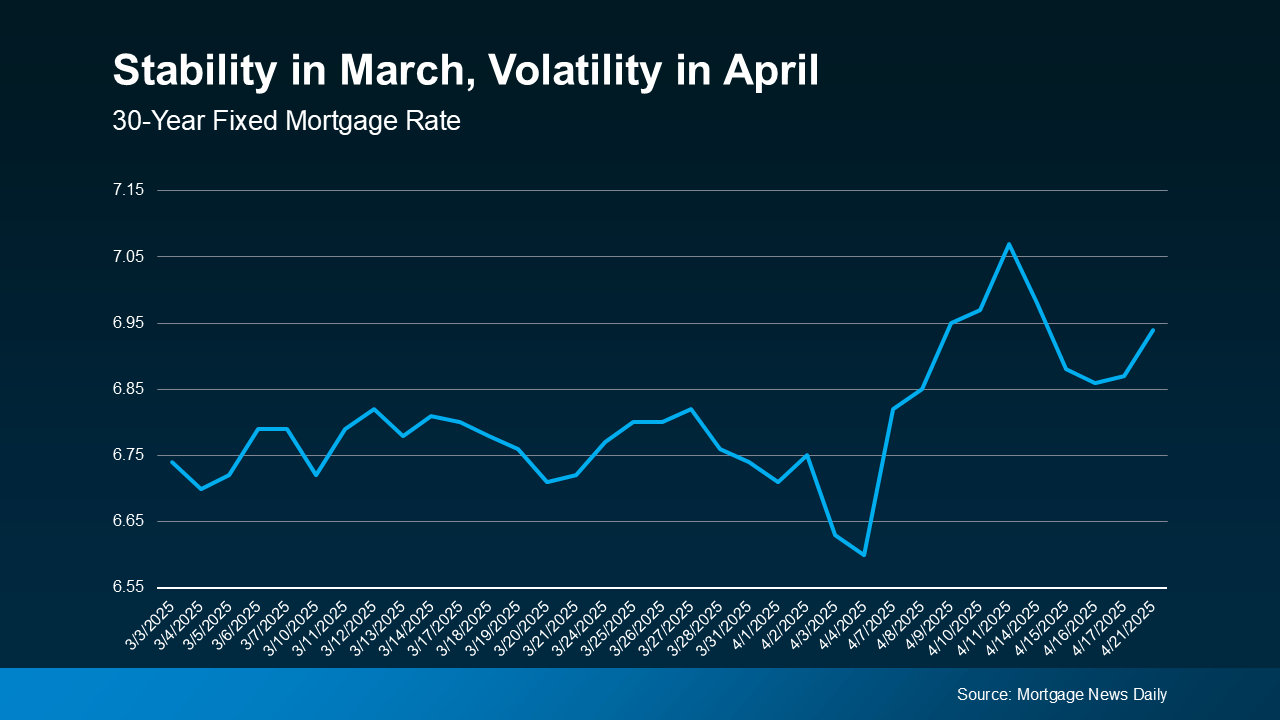

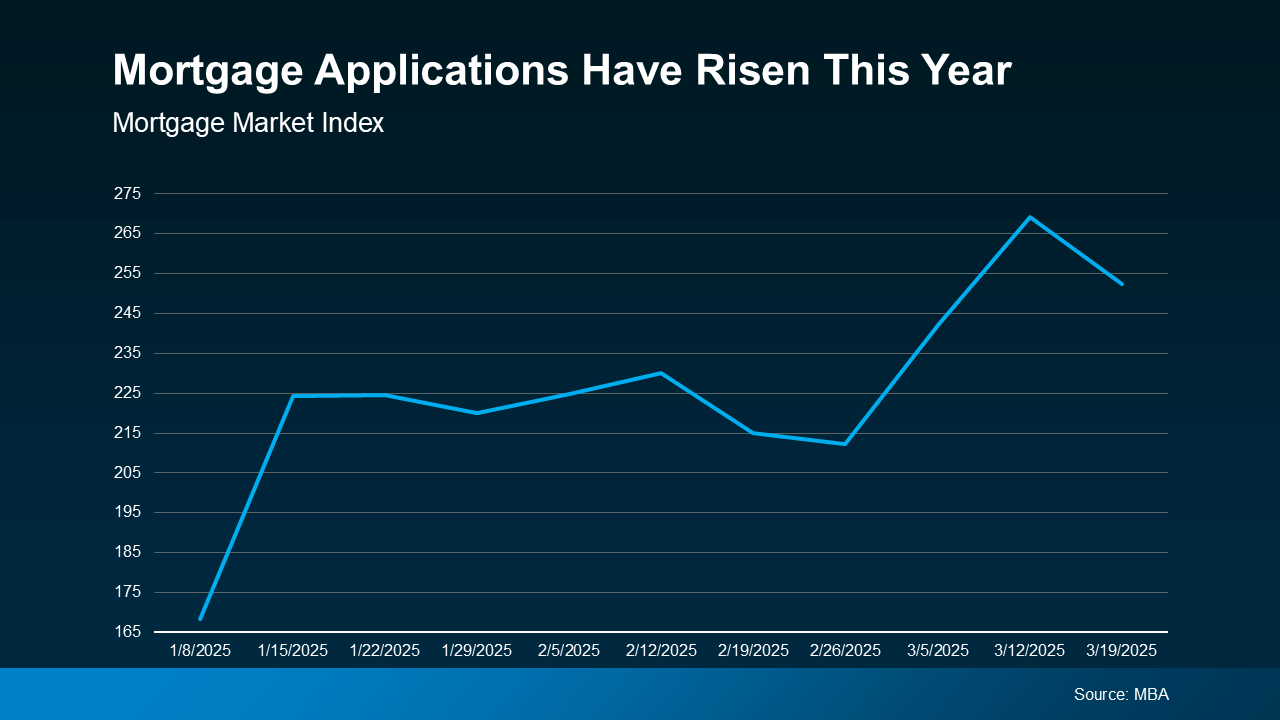

This kind of up-and-down volatility is expected when economic changes are happening.

This kind of up-and-down volatility is expected when economic changes are happening.

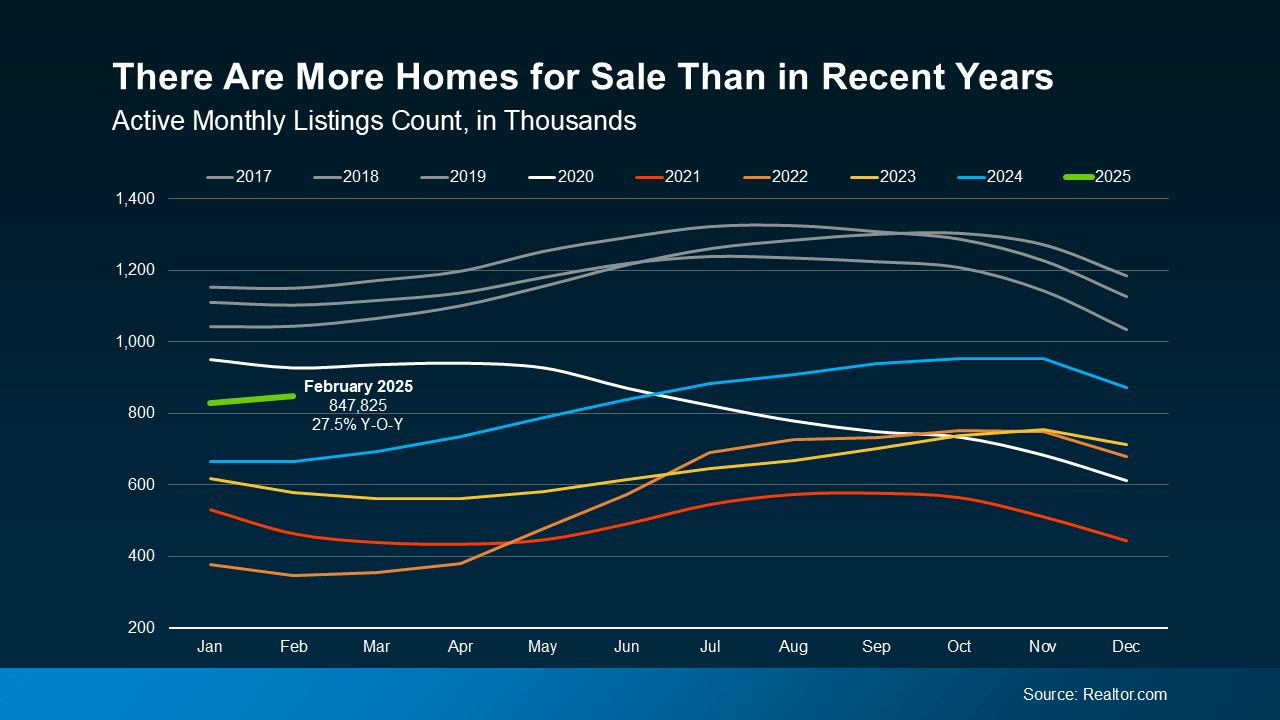

Buyers: This means you have more choices, and you can be more selective.

Buyers: This means you have more choices, and you can be more selective. Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.