If you’re like a lot of homeowners, you’ve probably thought: “I’d like to move… but I don’t want to give up my 3% rate.” That’s fair. That rate has been one of your best financial wins – and it can be hard to let go. But here’s what you need to remember…

A great rate won’t make up for a home that no longer works for you. Life changes, and sometimes, your home needs to change with it. And you’re not the only one making that choice.

The Lock-In Effect Is Starting To Ease

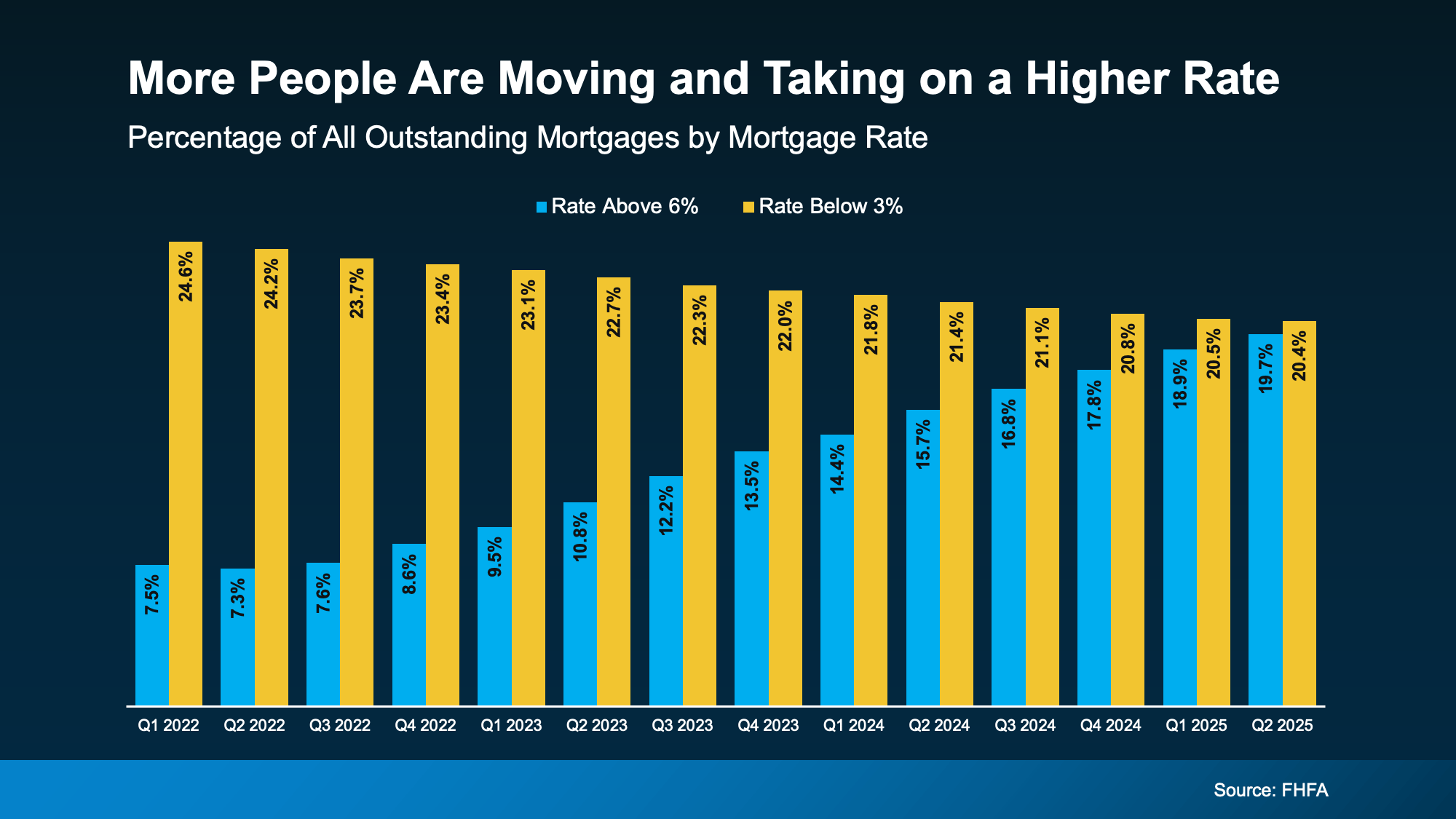

Many homeowners have been frozen in place by something the experts call the lock-in effect. That’s when you won’t move because you don’t want to take on a higher rate on your next home loan. But data from Federal Housing Finance Agency (FHFA) shows the lock-in effect is slowly starting to ease for some people.

The share of homeowners with a mortgage rate below 3% (the yellow in the graph below) is slowly declining as more people move. And while some of the people with a rate over 6% are first-time buyers, the number of homeowners with a rate above 6% (the blue) is rising as others take on higher rates for their next home:

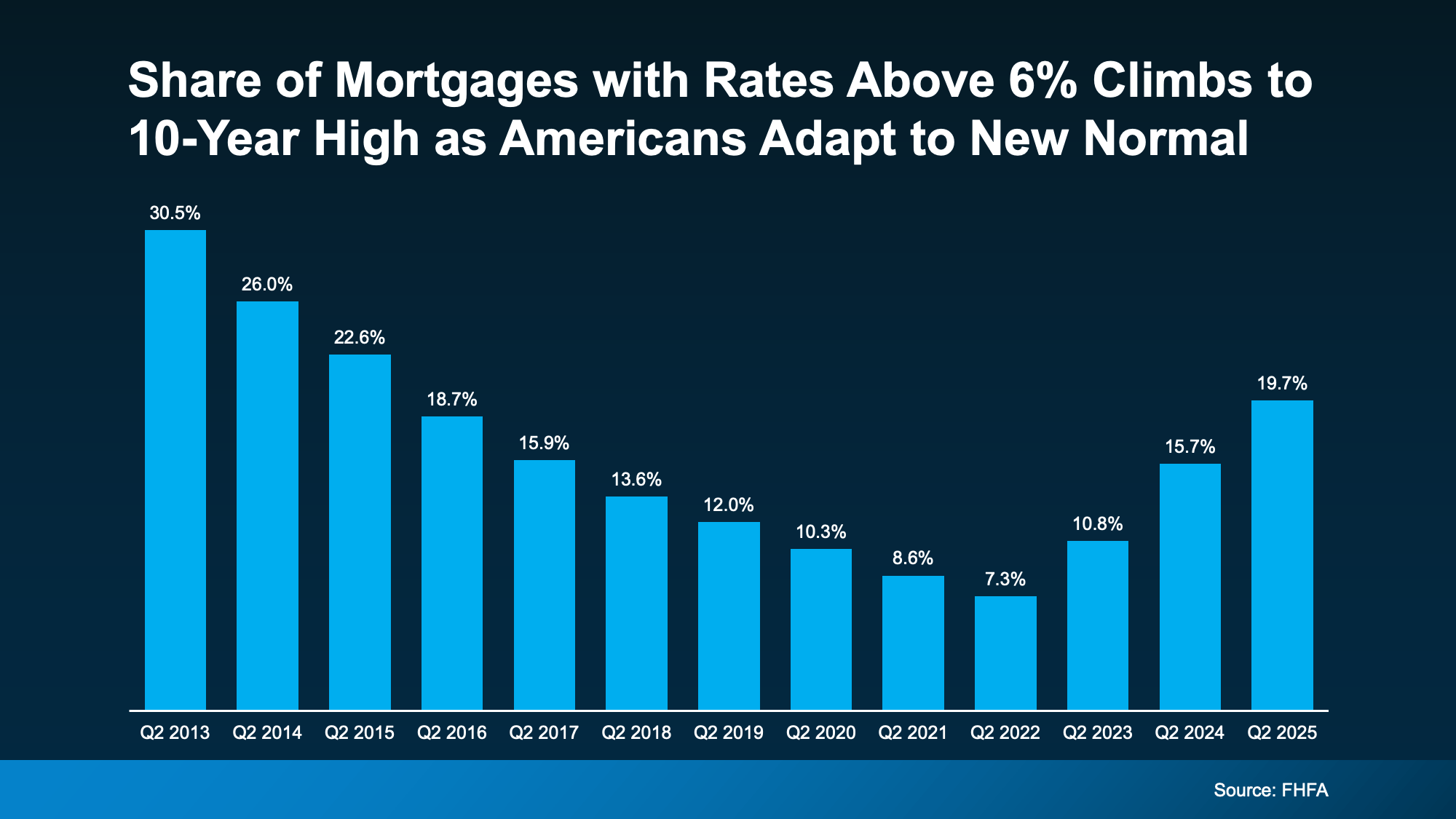

And while it may not seem that dramatic, it’s actually a pretty noteworthy shift. The share of mortgages with a rate above 6% just hit a 10-year high (see graph below). That shows more people are getting used to today’s rates as the new normal.

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

It’s simple. Sometimes they can’t put their life on pause anymore. Families grow, jobs change, priorities shift, and a house that once fit perfectly may not fit at all anymore – no matter how good their rate was. And that’s okay. As Chen Zhao, Head of Economic Research at Redfin, explains:

“More homeowners are deciding it’s worth moving even if it means giving up a lower mortgage rate. Life doesn’t standstill—people get new jobs, grow their families, downsize after retirement, or simply want to live in a different neighborhood. Those needs are starting to outweigh the financial benefit of clinging to a rock-bottom mortgage rate.”

First American refers to these life motivators as the 5 Ds:

- Diplomas: People with college degrees typically earn more, and that adds up to more buying power. Maybe you bought your house when you were younger and now that you’ve graduated and have a rising career, you’re ready to move up.

- Diapers: You’ve outgrown your space. If you’re welcoming a new baby, your current home might not be cutting it anymore.

- Divorce: Whether it’s ending a marriage (or starting one), it can create the need for a new place to call home.

- Downsizing: You’re ready to downsize. Maybe the kids have moved out and it’s time to simplify. Smaller house, less maintenance, more freedom.

- Death: If you’ve recently lost a loved one, maybe you’ve realized you want to be closer to family. Life’s too short to live far from the people who matter most.

Whatever your reason, here’s what you need to think about. Yes, your low rate is great. But staying put means your life may stay on hold. And maybe that’s not working for you anymore.

According to Realtor.com, nearly 2 in 3 potential sellers have already been thinking about moving for over a year. That’s a long time to press pause on your plans. On your needs. On your family’s goals. So, maybe the question isn’t: “Should I move?”

It’s actually: “How much longer am I willing to stay somewhere that no longer fits my life?”

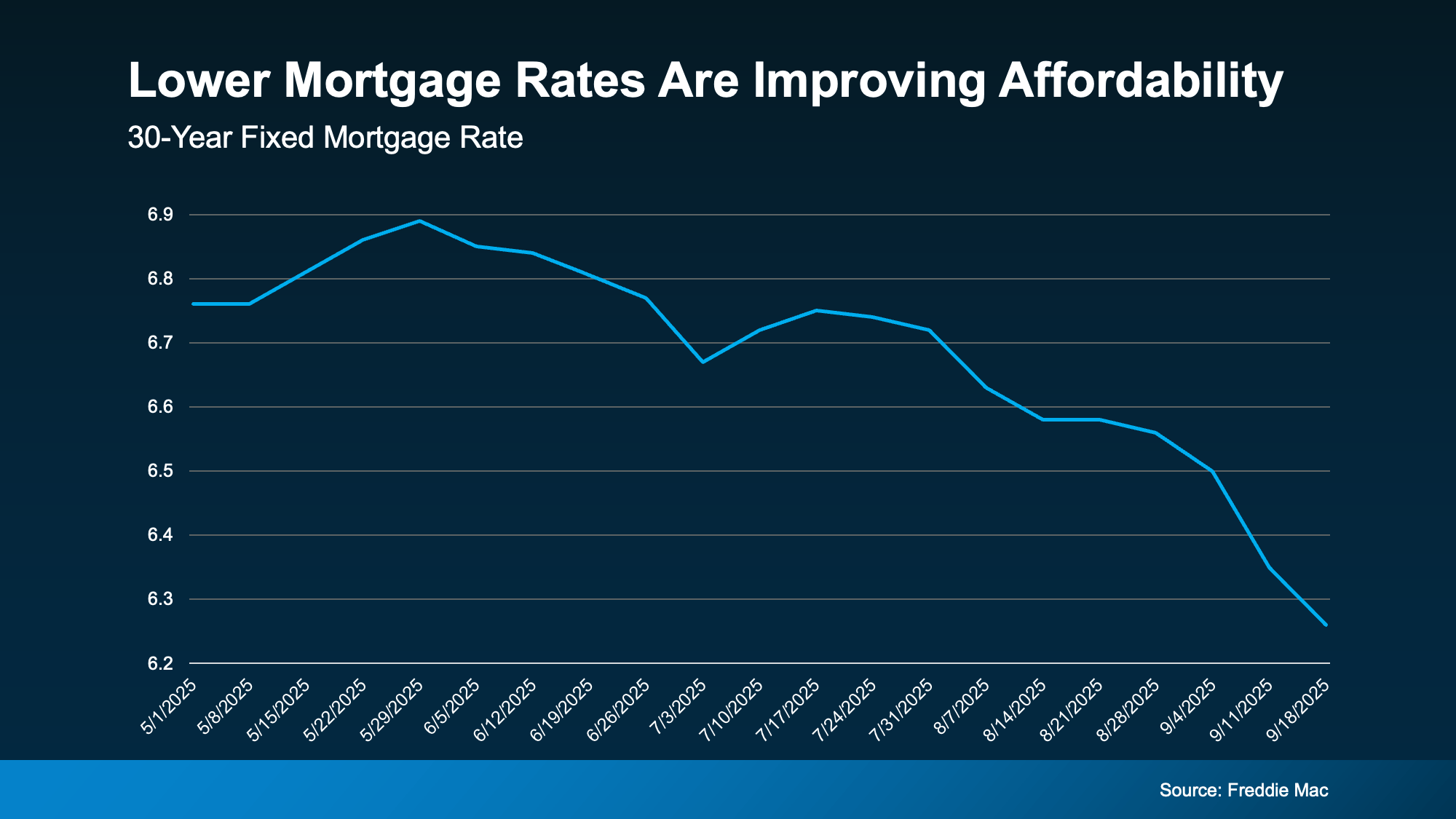

Because we’ve already seen rates come down from their peak earlier this year. And they’re expected to ease a bit more in 2026. When you stack that on top of the very real reasons you may need a new home, it may be enough to finally move the needle for you.

Bottom Line

Life doesn’t wait for the perfect rate. Maybe you shouldn’t either.

With mortgage rates down from their peak and forecast to dip slightly more in 2026, moving may be more feasible than you think. If you’re ready to see what’s possible in our market, let’s talk.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

Why Are More People Moving Now, if It Means Taking on a Higher Rate?

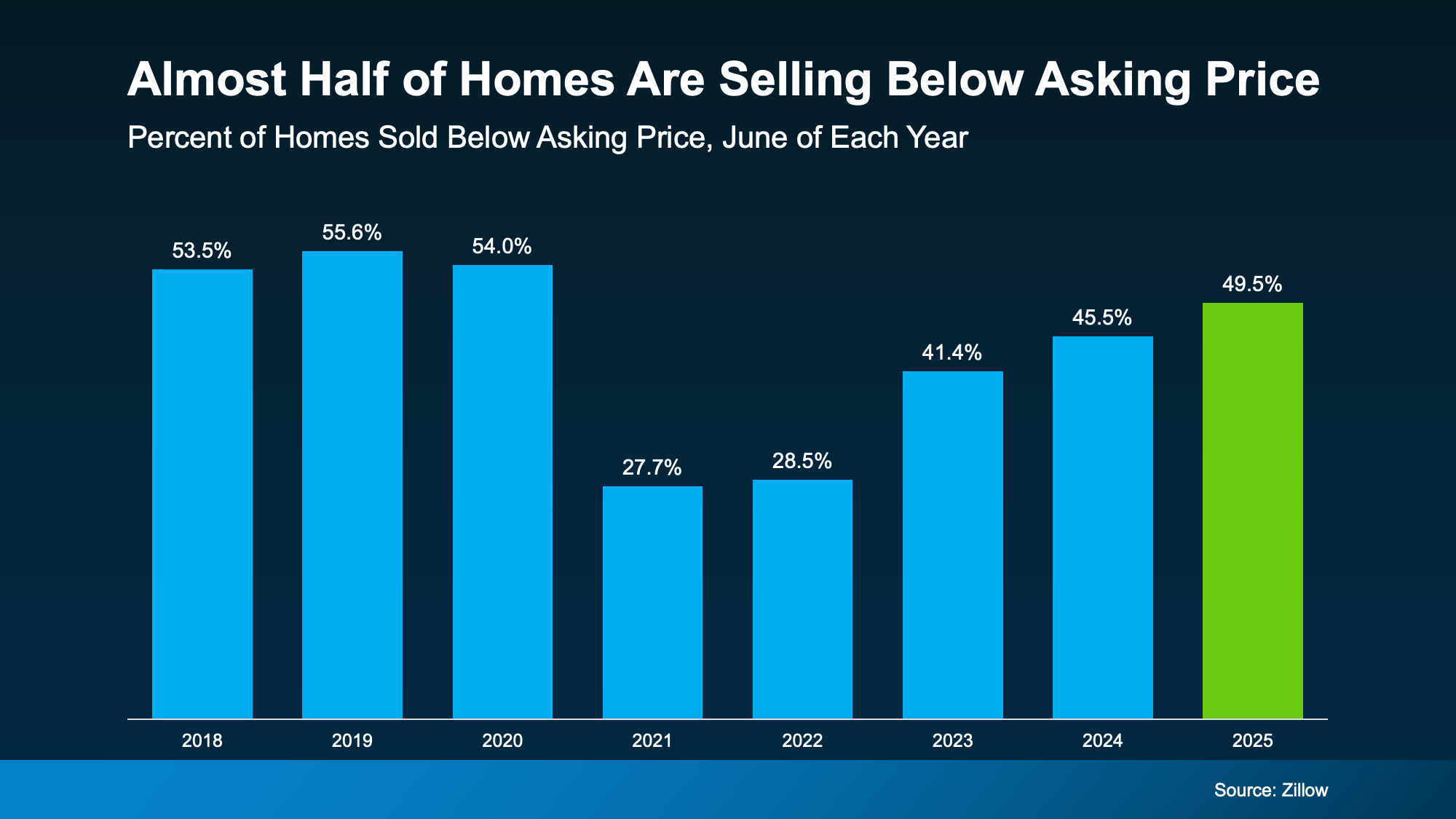

Zillow sums it up best:

Zillow sums it up best:

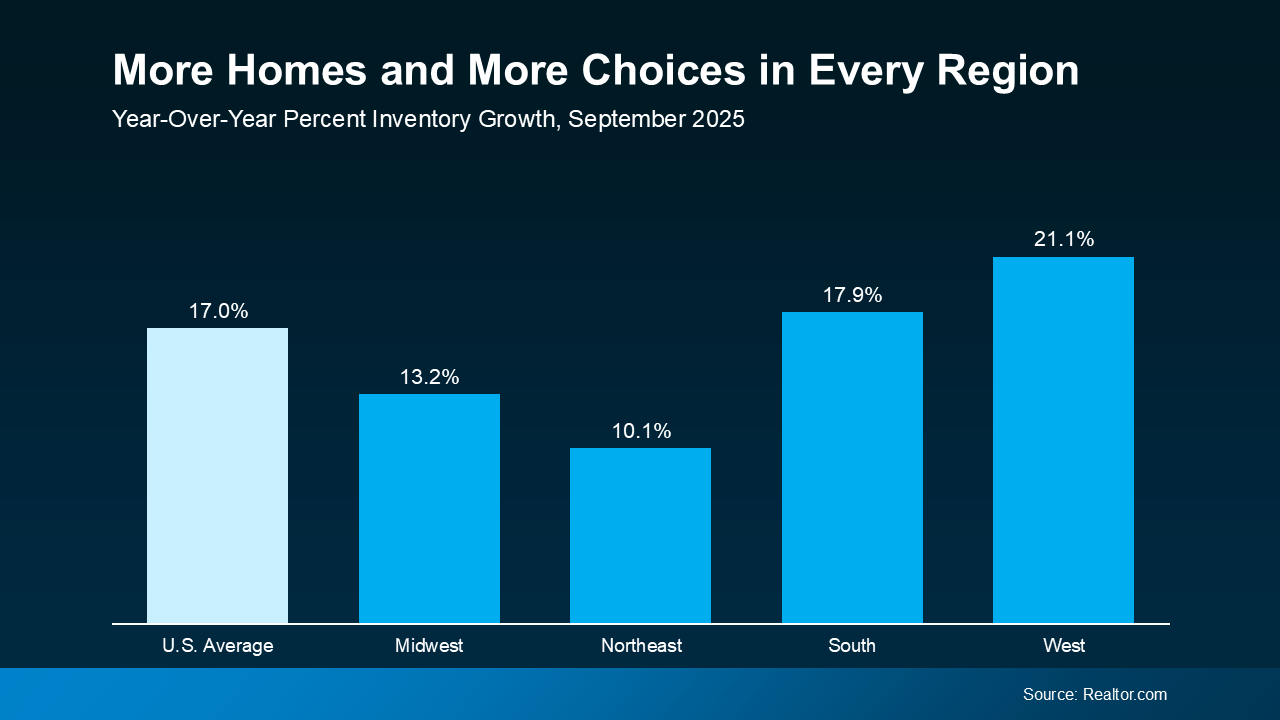

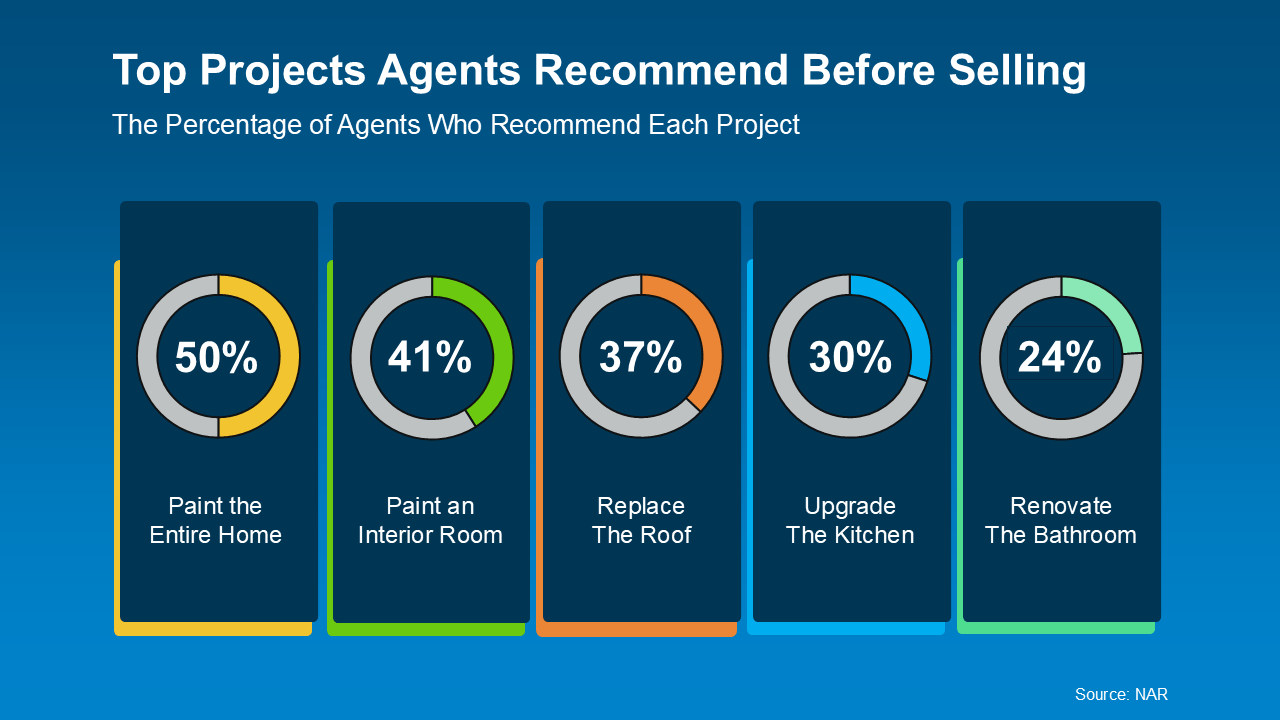

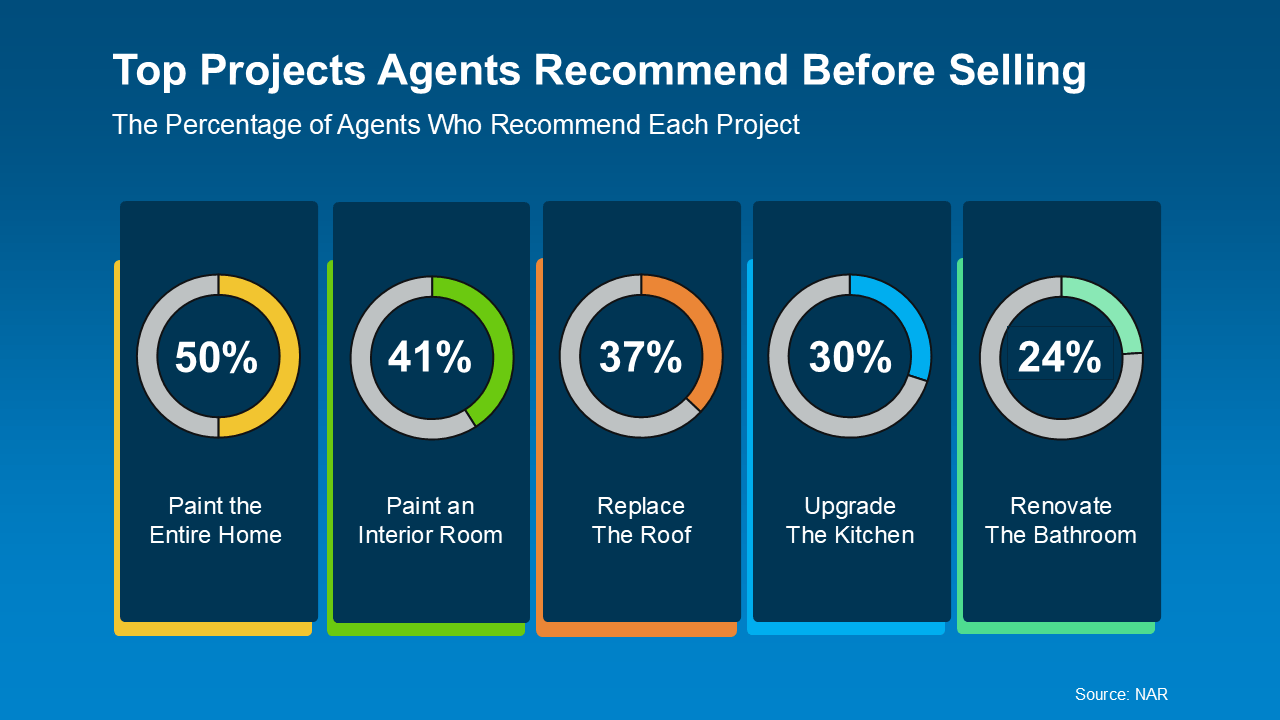

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

Just remember, what’s worth updating really depends on the homes you’re competing with in your market. Some areas don’t have a ton of inventory, so little updates may be all you need to tackle. In other areas, there are far more homes for sale, so you may need to do a bit more to make your house stand out.

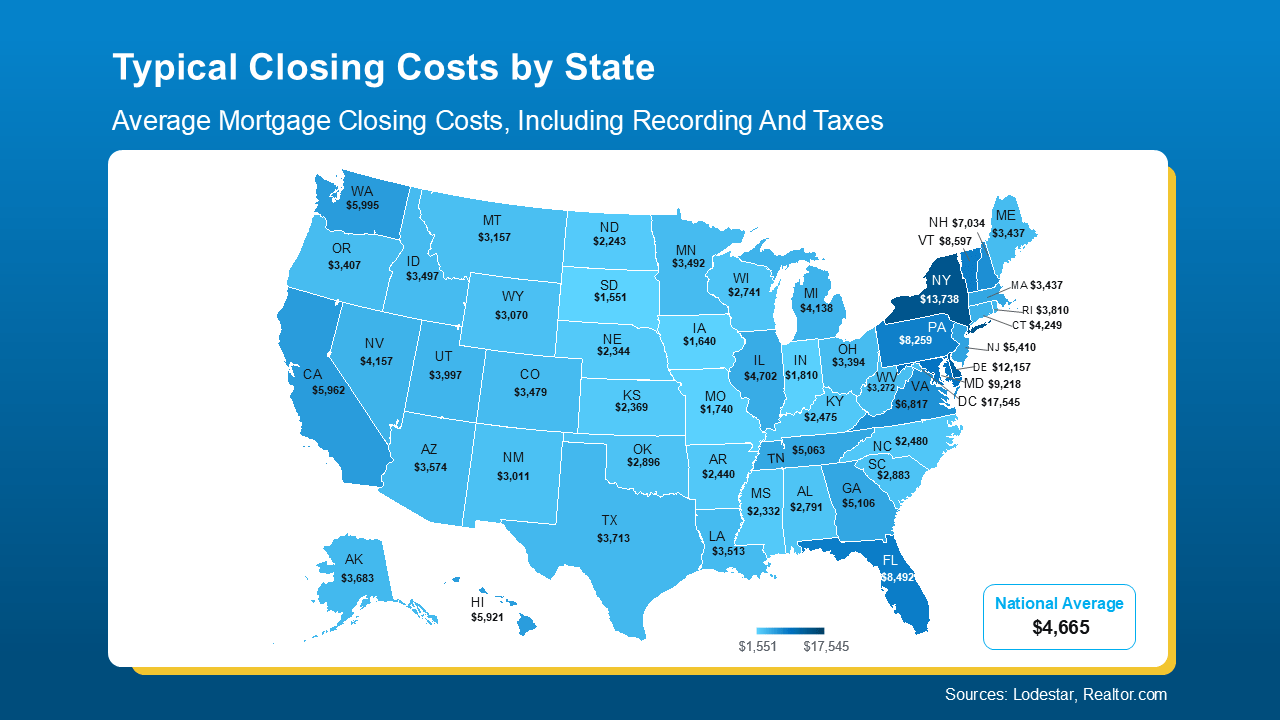

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

As the map shows, in some states, typical closing costs are just roughly $1-3K. In a few places, they can be closer to $10-15K. That’s a big swing, especially if you’re buying your first home. And that’s why knowing what to expect matters.

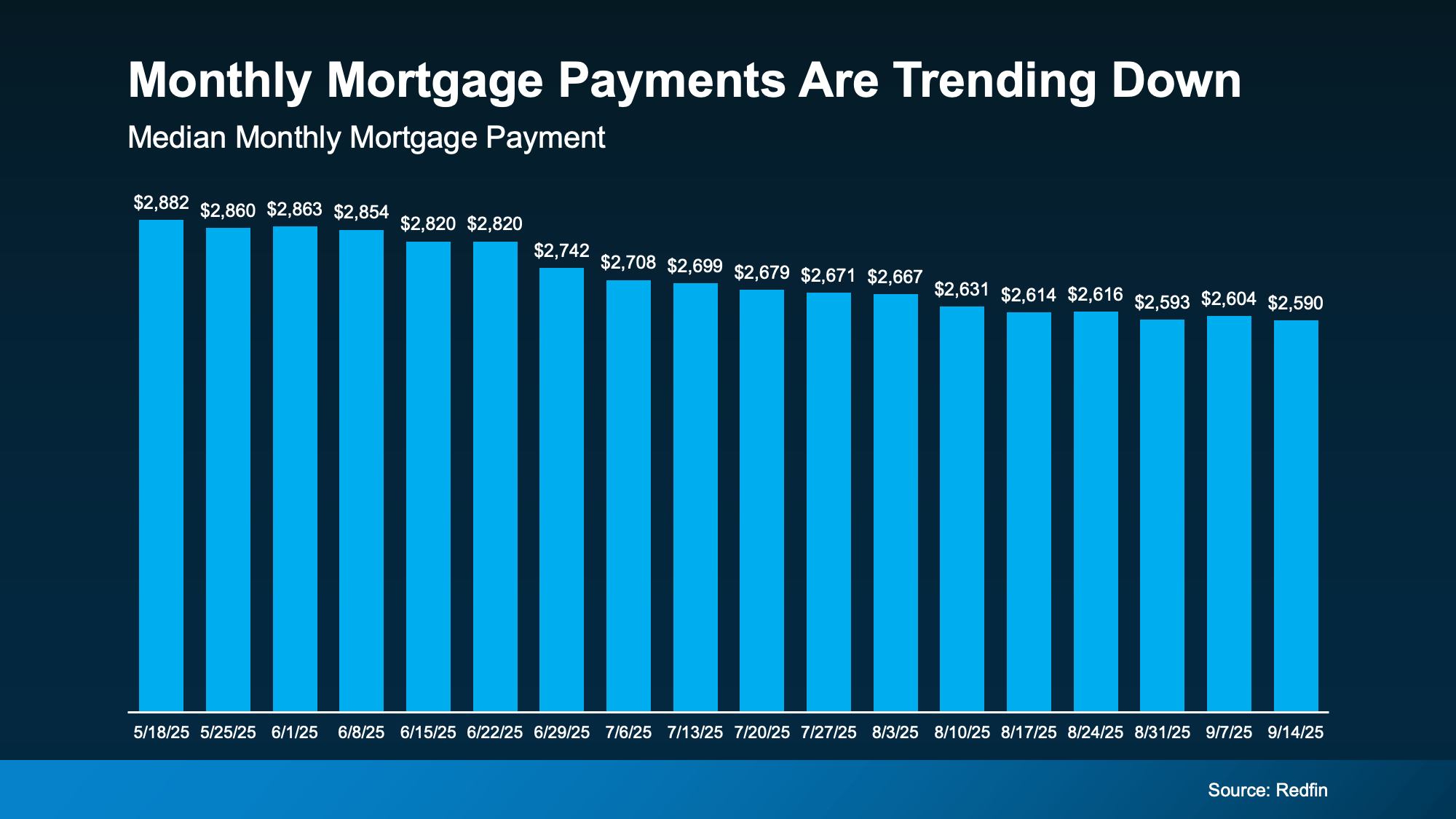

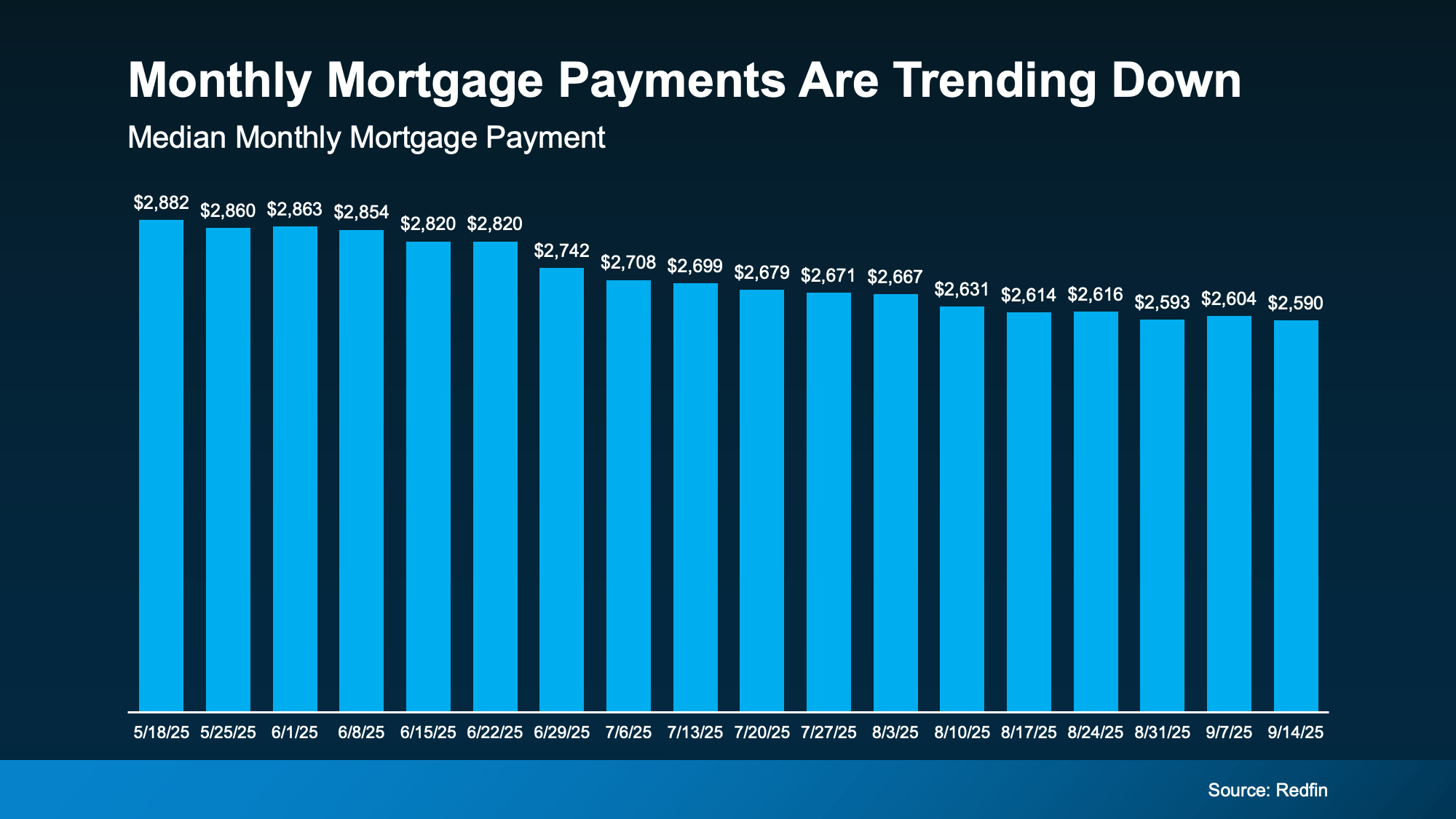

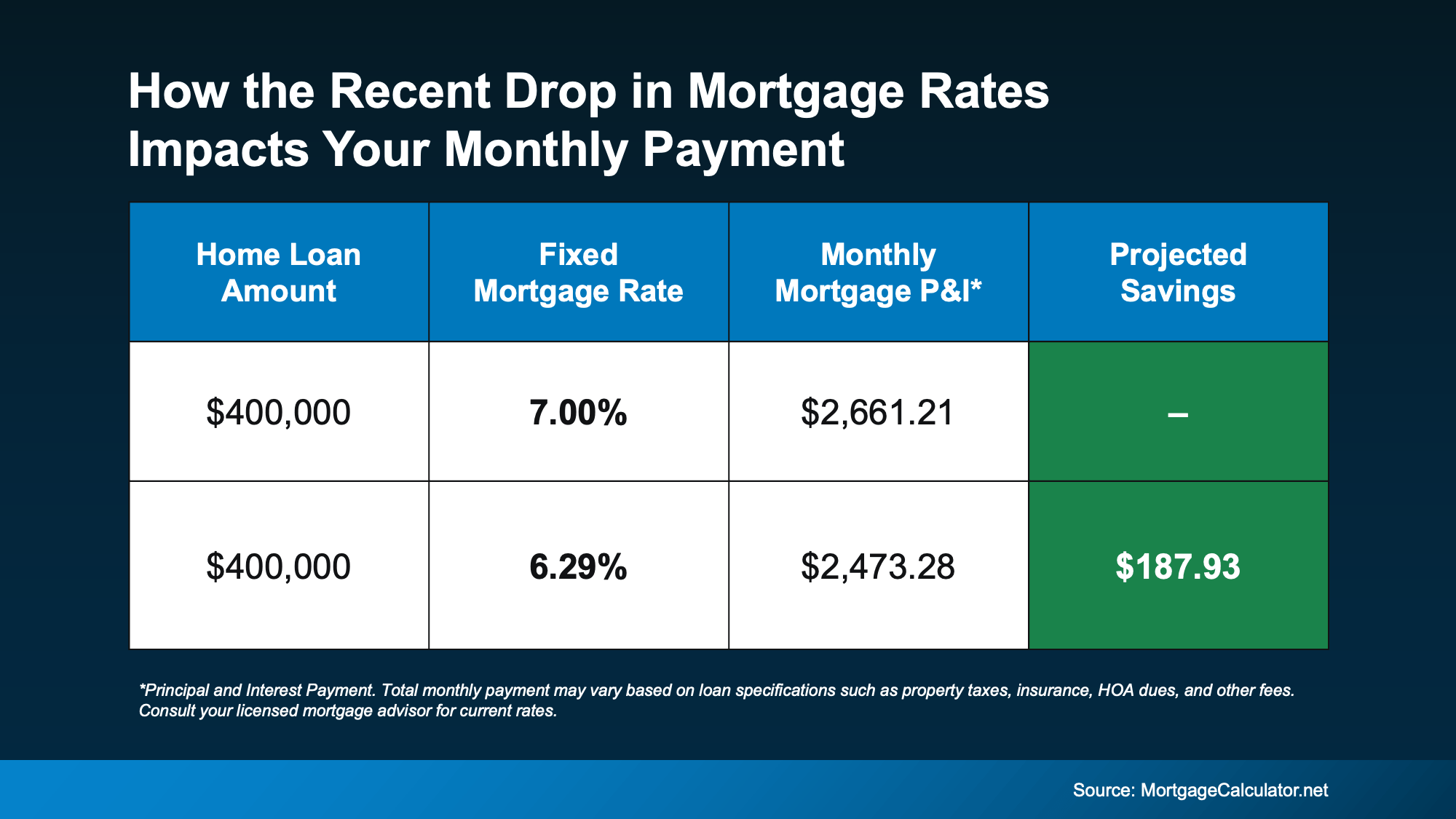

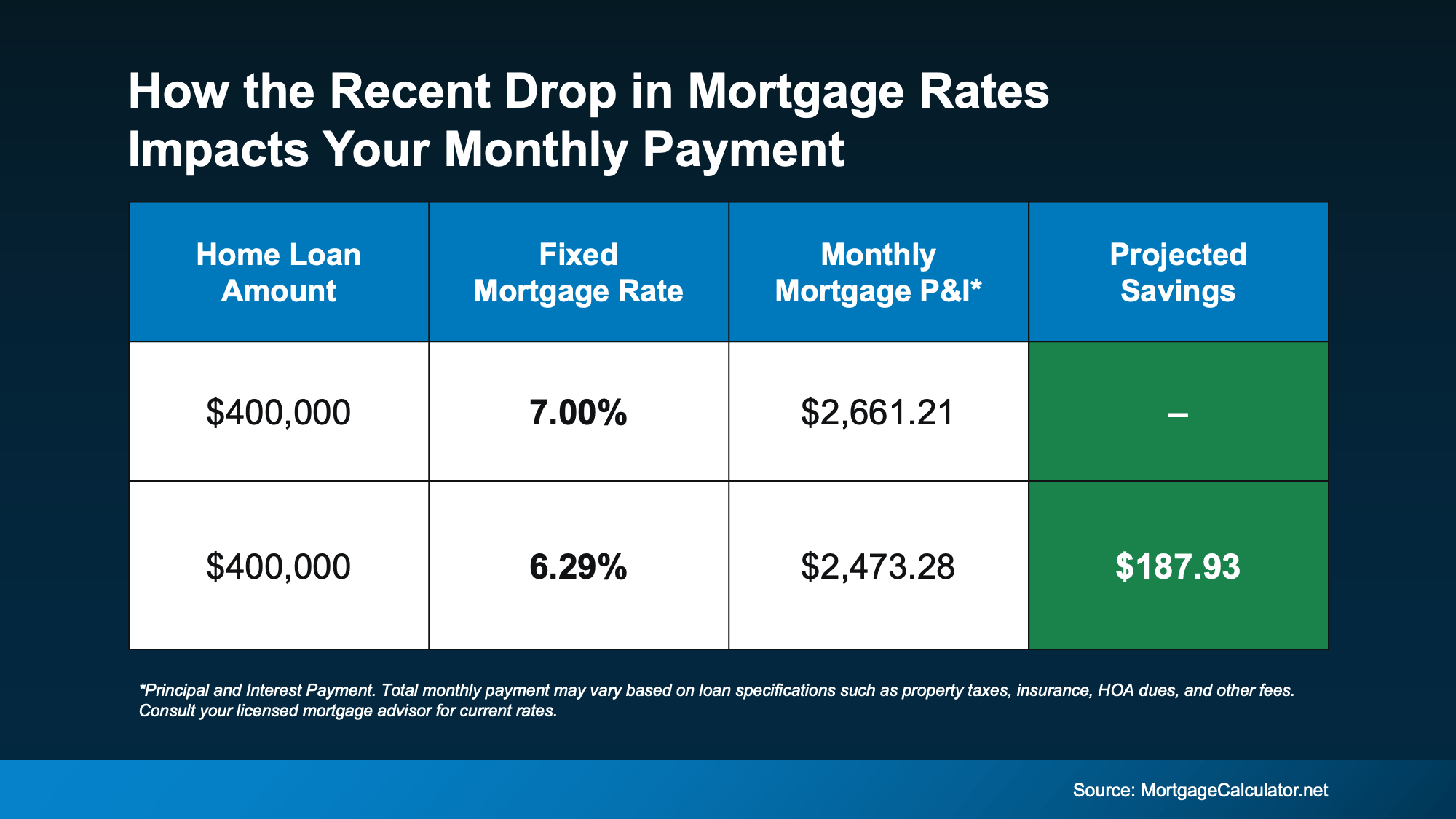

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

Compared to just 4 months ago, your future monthly payment would be almost $200 less per month. That’s close to $2,400 a year in savings.

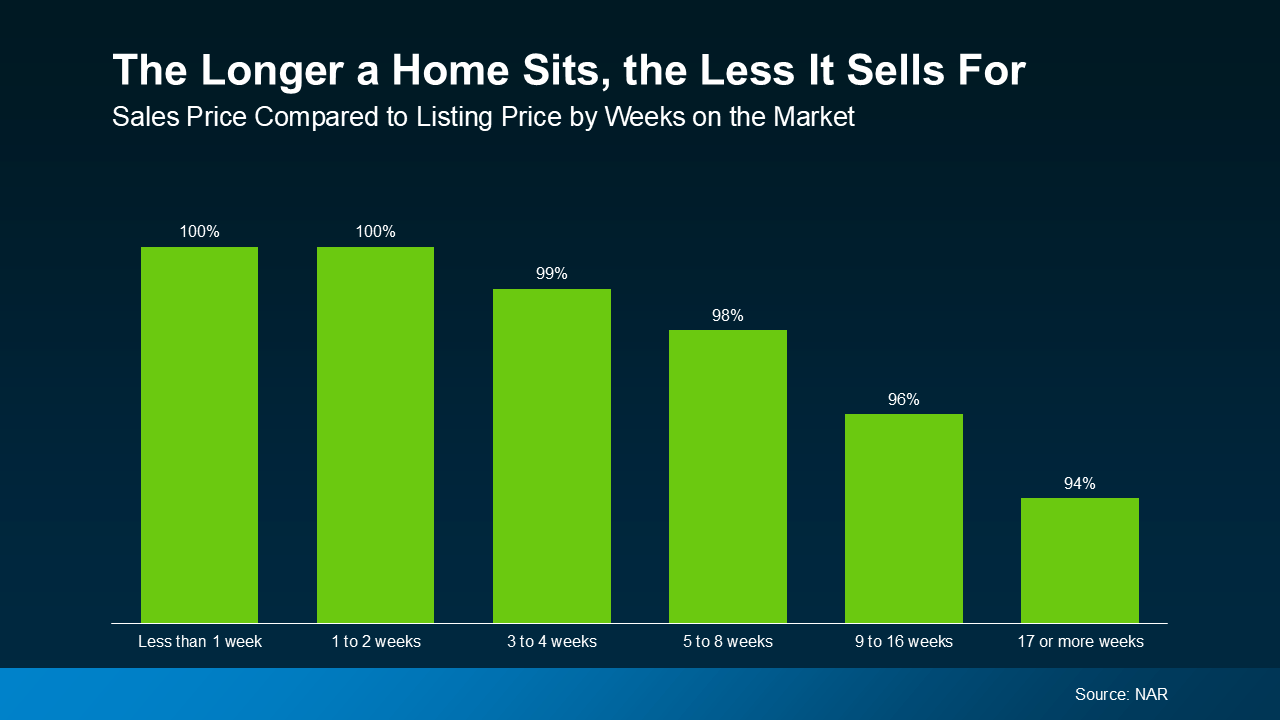

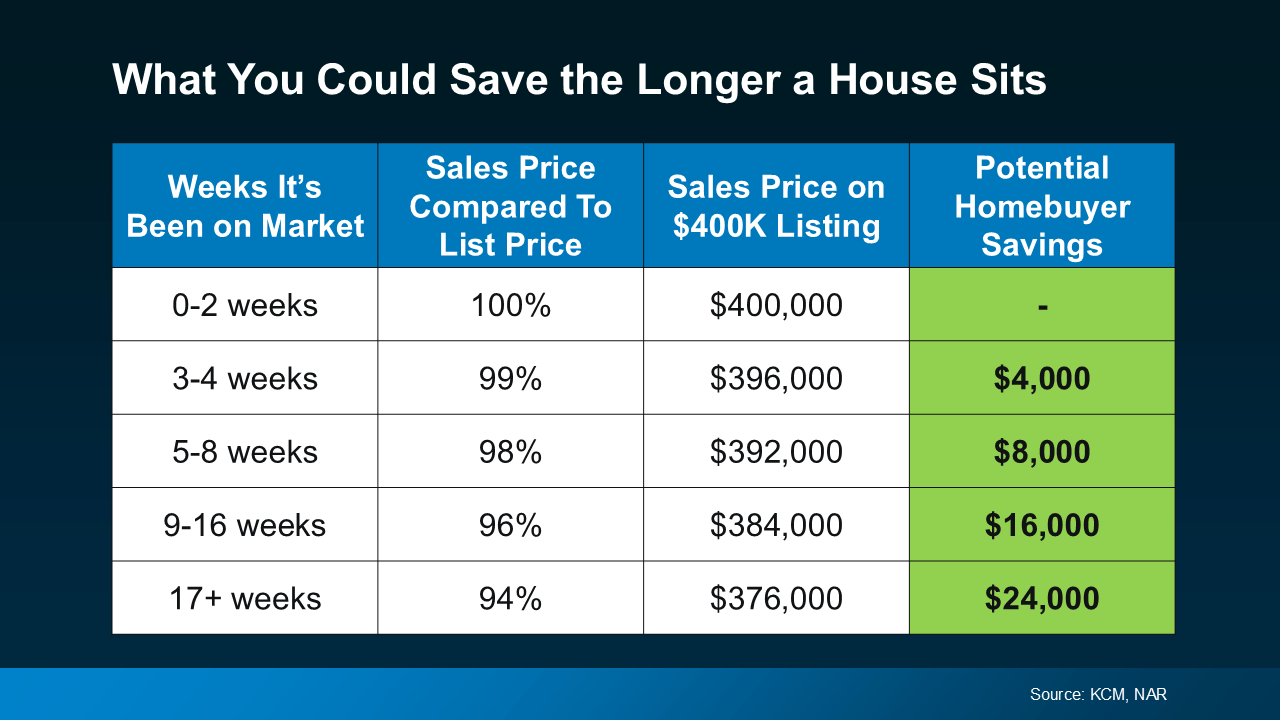

Why This Matters If You’re Selling Your House

Why This Matters If You’re Selling Your House